Although there has been a short-term economic recovery following the quarantine, the crisis caused by the COVID-19 will have long-term effects on society, business, consumer habits, mobility, media usage and certainly on the advertising industry, reported by Polaris.

Estimates made before the crisis which predicted growth in advertising spend are increasingly being revised down, while new calculations reveal that global investment in advertising will be not nearly as expensive in 2023 in most regions and a major part of advertising channels will be impacted by it.

Net purchase of advertising in 2023 is projected to be -7.2% lower globally compared to the year prior. The largest losses will be suffered by advertising in cinemas (-42%), accompanied by print having a drop of -32%. It is estimated that OOH will fall by -22% this season because advertisers have largely abandoned this medium (especially during quarantine) due to reduced movement and the decreased number of individuals it may reach. Although TV viewership increased throughout the state of emergency, advertising about this medium has declined and it is predicted to fall by -12% after 2023. The explanation for this is the abstinence of many major brands from TV advertising during the crisis; however, the cancellation of big sporting events is also adding to the steep decline. Investment in radio advertising will also be lower by an estimate of -15% as this medium mainly trusted listening while driving, and for that reason its reach is smaller during times of limited movement. Digital formats are the only ones that are projected to become at last year’s level (+ 1%) because of greater internet usage by consumers, growing e-commerce, and shifting marketing budgets to cheaper channels, which is usual for any recession.

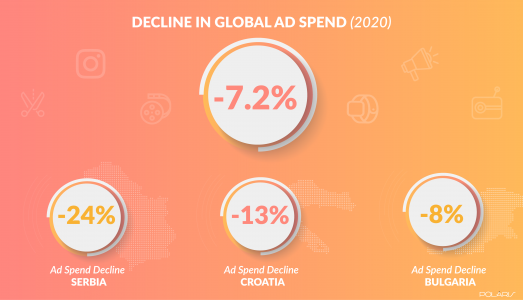

All regions will be affected by the crisis, but The european union and Latin America are affected probably the most (expected decline of -10%), while The united states (-4.4%) is going to be least affected, due to the positive spillover of political campaigns ad spend throughout the 2023 elections. The decline in the Central and Eastern European region is estimated at -7.7%.

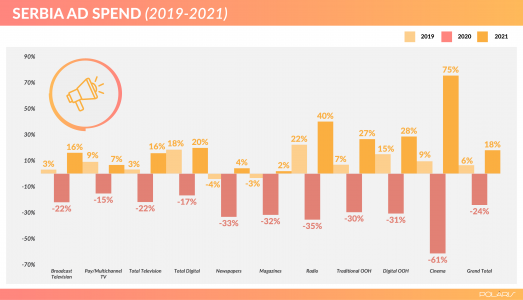

When it comes to the countries in this area, Serbia is most affected – investments in advertising are lower by -24% compared to the previous year. The Croatian advertising market will decline by -13% in 2023, while Bulgaria expects home loan business an investment of -8% by the end of the year. Following global patterns, cinema advertising are affected the best consequences in the region (-61% in Serbia, -50% in Croatia and -20% in Bulgaria). This is accompanied by OOH and print (between -30% and -35% in Serbia and Croatia, and -15% in Bulgaria). Serbia shows worrisome numbers when it comes to advertising on TV (-22%), while in Croatia and Bulgaria this figure is lower (-13%). Investment in digital media in Croatia is stagnating and therefore following the global trend; however, Serbia recorded a decline of -17% within this medium, while Bulgaria, on the other hand, and has a rise of + 6%.

Forecasts for 2023 are optimistic – according to IMF estimates, the global economy will recover (GDP + 5.8%), and major sports will have a significant effect on the recovery from the advertising industry and ad spend. The data implies that the worldwide advertising market will grow by + 6.1%, but despite the recovery expected in 2023, investments will be lower by $ 9 billion compared to the period prior to the COVID-19 crisis. In the region, Serbia is projected to recuperate by almost + 18% when compared with 2023, but given the large decline, investments will still be lower than 2023 (187 million in 2023 vs. 209 million in 2023). Croatia and Bulgaria also expect growth of + 13% and + 6%, which brings both countries to the stage of investments from 2023.

By Polaris agency