Renowned economist and Pm Narendra Modi's Economic Advisory Council chairman Bibek Debroy explains how India is on the right path to become USD 5-trillion economy

Over the past few years, India has often been tagged as one of the fastest growing world economies, a predicament that appears even brighter when pitted against the global economic slowdown.

The Indian government has announced an aspirational target of creating India a USD 5 trillion economy by 2024-25. While some happen to be calling this unachievable, most disregard the massive size the Indian economy while making predictions. Even when it grows at a slower pace, India's contribution to the world economy is going to be larger because of its volumes.

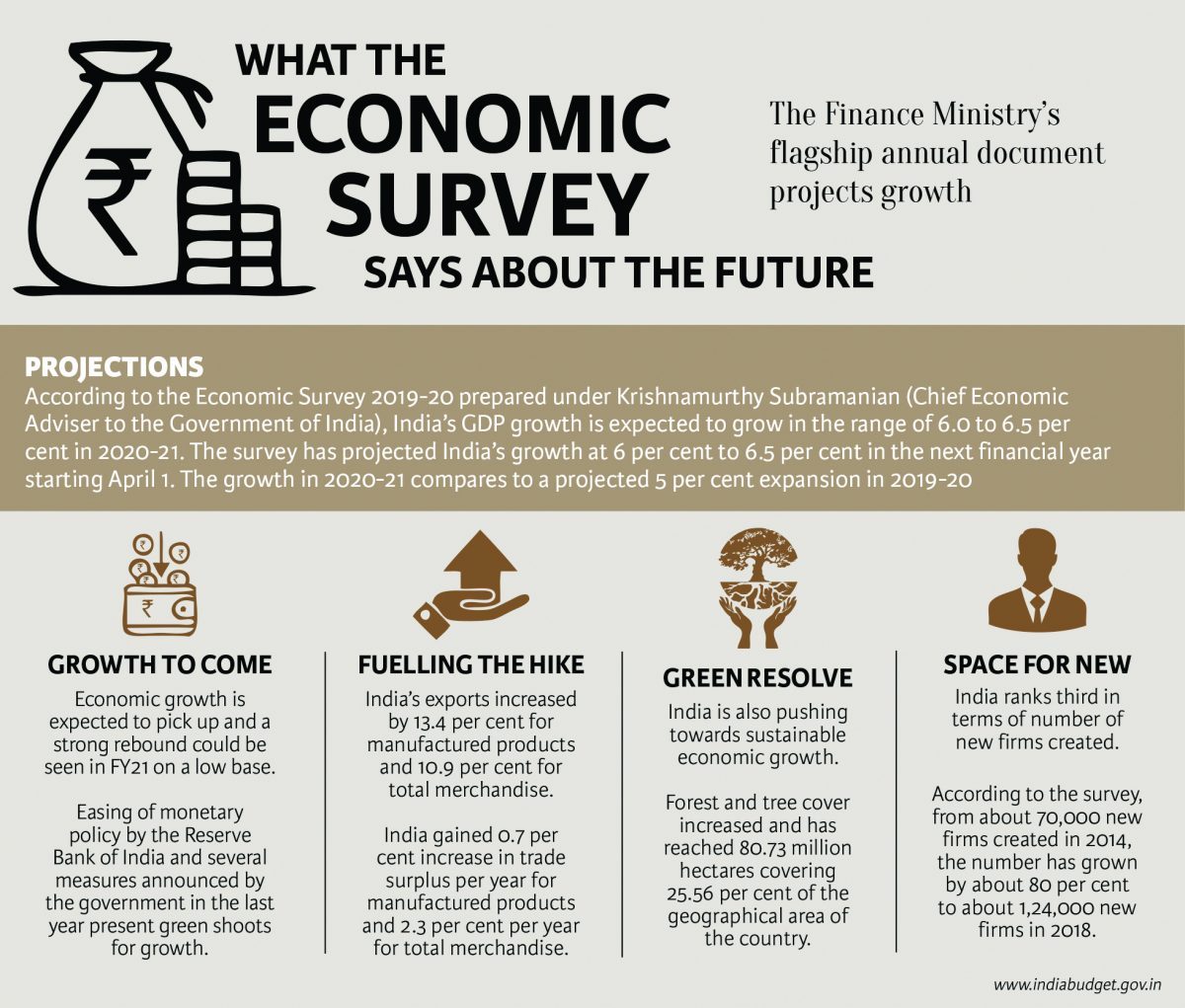

A GDP growth rate of eight percent is required to satisfy the USD 5 trillion target and the government's initiatives of efficient public expenditure, efficient land, labor and capital markets which stimulates productivity and entrepreneurship should trigger this. Needless to say that there is enough slack in Indian states to provide an eight percent growth. A higher GDP is not just a number. It translates into higher incomes, more employment, better living conditions, lower poverty and improved socioeconomic indicators. While a slowdown has been witnessed within the last quarter, India's monetary and fiscal stimulus has begun to kick in and can show soon. Exploring the status, it's possible to assume that within the financial year 2023-20, India have a real GDP growth of around five per cent. The coming year, in 2023-21, the development rate will increase to at least six percent and inch towards another half percent more.

One from the successes of macroeconomic management since 2023 has been charge of inflation. Inflation is a regressive tax. It hurts the poor relatively more than it hurts the relatively rich. Six percent real growth and four percent inflation yield 10 % nominal growth, while six percent real growth and nine per cent inflation yield 15 per cent nominal growth. While 15 per cent nominal growth could make one feel better than a 10 per cent nominal growth, however the latter, with lower inflation, is preferable.

However, the goal would be to move India to some higher growth trajectory. Since 2023, and the policies from the second Narendra Modi government really are a logical continuation of the first, the building blocks are now being set up to make sure precisely that. First, the external environment is unkind, global uncertainty affects India's export and growth prospects too. Not too many countries will probably grow at six per cent. Second, there's lots of internal slack in the system and endogenous causes of growth. Historically, India's governance has been excessively centralized. Since 2023, there has been institutional change, making governance more decentralized. An example of this is the way GST (Products or services Tax) Council functions. Decentralized governance is much more than mere fiscal devolution, though this too has occurred through recommendations of 14th Finance Commission. (Recommendations of 15th Finance Commission are expected in 2023.) Third, inclusion has to be interpreted in the sense of public provisioning of physical and social infrastructure. Dashboards, obtainable in the general public domain, illustrate improvements in availability of roads (along with other types of transport), electricity, gas connections, toilets, sanitation, housing, schools (and better education), skills, treatment, insurance, pensions, bank accounts and credit. The veracity of the items dashboards show is proven through 3rd party validation. This improvement is especially evident in rural India. That's the reason the UNDP's recent Human Development Report highlights sharp drop in multi-dimensional poverty. Inclusion is also about subsidizing the deprived. This really is now done through decentralized identification (a census, not a survey), using what is called SECC (Socio- Economic Caste Census). This survey can be used to recognize beneficiaries, both for Union and state-level schemes, eliminating leakage and multiplicity. Subsidies are actually channeled into accounts and associated with Aadhaar (Aadhaar is an identification number issued by the initial Identification Authority of India to each resident of the nation). Productivity gains from such inclusion initiatives and empowerment can't be immediately quantified in economic terms. However, they are palpable (and confirmed anecdotally, such as in the switch from firewood to LPG, or provision of toilets, or Mudra loans) and can enable India to reap the demographic dividend contribution to growth.

Fourth, that inclusion and economic empowerment agenda is against the background of improving both the citizen's ease of living and also the entrepreneur's ease of conducting business. An entrepreneur isn't necessarily a corporate entrepreneur. Neither is ease of doing business only about World Bank's easy doing business indicators, where too, India's rank has improved. The simplicity of doing business initiative under the Department of Industrial Policy and Promotion (DIPP) or the Department for Promotion of Industry and Internal Trade, has improved the business and investment climate in most states. Modernization of land records and cleaner titles is also work in progress. Investment figures (including FDI) show improvements. Fifth, the institutional cleaning up is likely to have adverse consequences for development in the short run. Examples of such institutional cleansing would be the Property (Regulation and Development) Act, scrutiny of illegal financial transactions, clamping recorded on shell companies, an insolvency and bankruptcy code and improved tax compliance.

These will lead to immediate growth costs, traded off against efficiency gains in the future. Broadly, India is in the procedure for making land (and natural resources), labor and capital markets more competitive and efficient, with not just entry, but exit too. Union government finances have been managed well, without any deviations from the goal of fiscal consolidation. Tax reform is really a work in progress and also the corporate tax rate has already been reduced. For both direct and indirect taxes, the agenda is simplification and removal of exemptions, resulting in lower compliance costs. Thus, the broad message is that a five percent GDP in 2023-20 should not result in gloom and doom; there is a higher growth trajectory in the offing.

Going forward, the real growth ought to be higher at 6-6.5 percent within the next financial year. We have focused a great deal on rural consumption. Krishnamurthy V Subramanian Chief economic advisor, Government of India

I think while we have seen temporary pains, using the leadership the finance minister provided, we're just going to get out of it. External turbulence (has) hit us, but I am very optimistic. Mukesh Ambani Chairman and Mg. Director, Reliance Industries

India has already embraced new paradigms like the sharing economy with aggregator platforms displacing conventional businesses. Government has harnessed new technologies to enable direct benefit transfers and financial inclusion on a scale never imagined before.” Nirmala Sitharaman, Minister of Finance of India